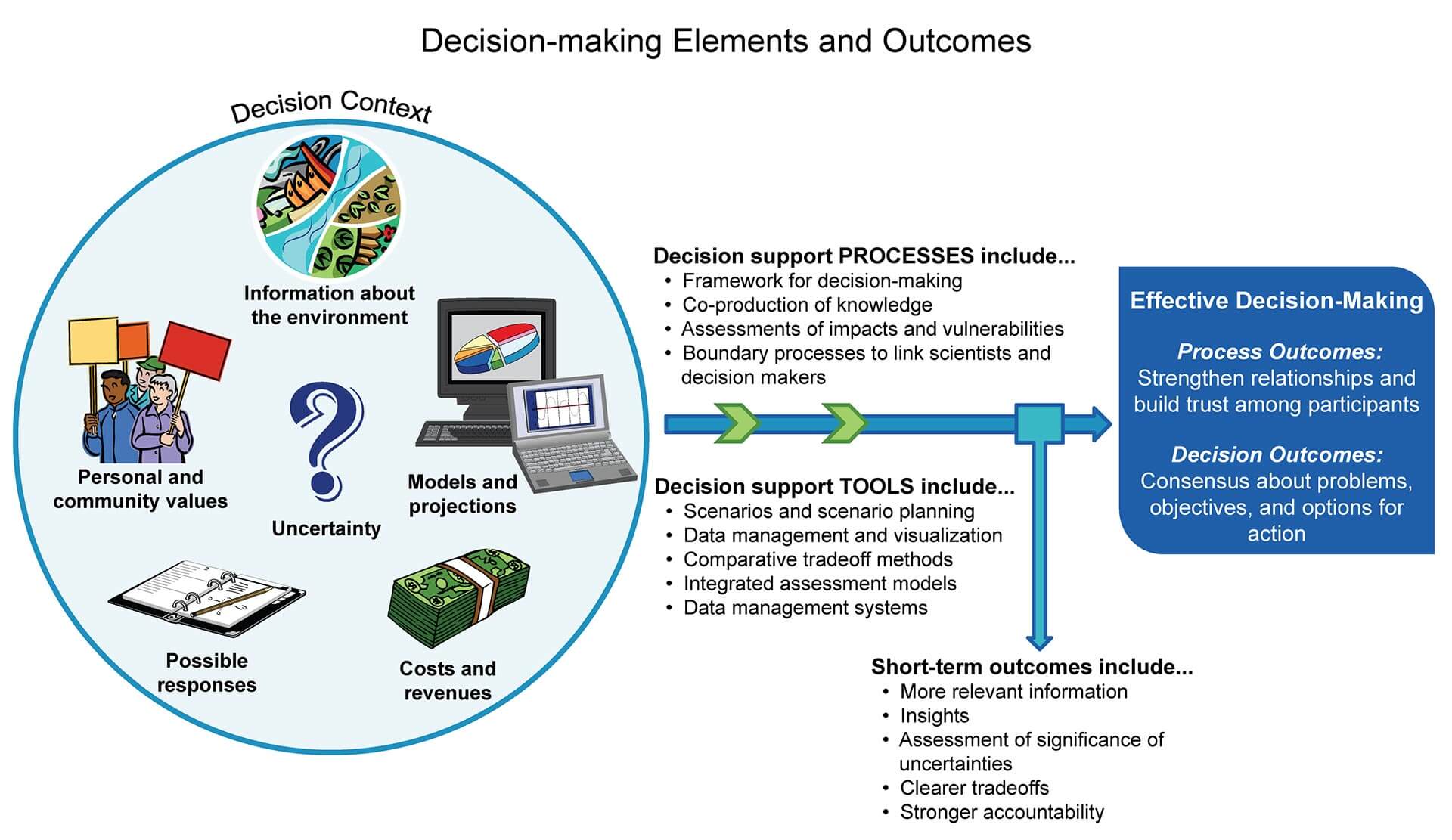

Most notably, 56% businesses using AI customer service, 51% cybersecurity fraud management 30% recruitment efforts. 2 professional services sector already reaping benefits this sophisticated, multifaceted technology these significant ways: Data-driven insights predictive analytics lead better-informed risk assessments, financial planning .

The insurance industry always about managing risks — individuals, businesses, society large. evaluating claims calculating premiums, insurers handle complex data decision-making processes day. the advent AI-driven agentic systems, potential enhance processes enormous. Imagine risk.

The insurance industry always about managing risks — individuals, businesses, society large. evaluating claims calculating premiums, insurers handle complex data decision-making processes day. the advent AI-driven agentic systems, potential enhance processes enormous. Imagine risk.

Lemonade a digital-first insurance company, it AI process claims a matter seconds. AI bot, "Maya," evaluate claims based the data by customer. 2020, Lemonade reported AI-powered solution reduced time resolve claims several days just few seconds.

Lemonade a digital-first insurance company, it AI process claims a matter seconds. AI bot, "Maya," evaluate claims based the data by customer. 2020, Lemonade reported AI-powered solution reduced time resolve claims several days just few seconds.

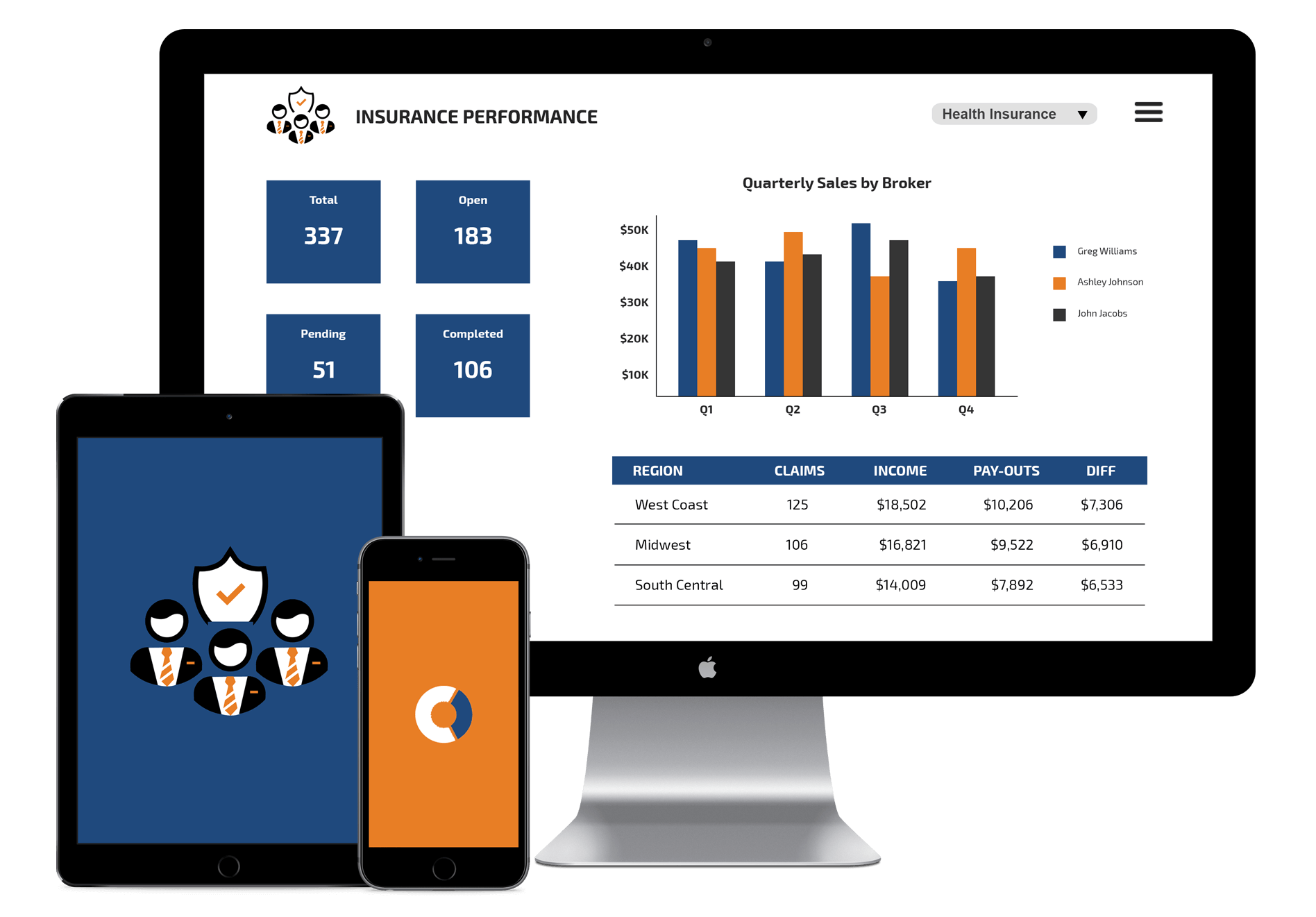

Other insurance companies SIC Insurance also making significant strides their BI journey, notably their advanced implementation an Enterprise Risk Management (ERM) programm. programme designed bolster corporate governance, improve responsiveness changing business conditions, enable staff evaluate .

Other insurance companies SIC Insurance also making significant strides their BI journey, notably their advanced implementation an Enterprise Risk Management (ERM) programm. programme designed bolster corporate governance, improve responsiveness changing business conditions, enable staff evaluate .

1. AI applications protect human dignity, rights fundamental freedoms.Create AI policy ensures compliance requirements including driving fairness transparency. 2. Ensure AI governance is consistent laws regulations.Including responsibilities frameworks assess review throughout entire life cycle AI, e.g.with model monitoring.

1. AI applications protect human dignity, rights fundamental freedoms.Create AI policy ensures compliance requirements including driving fairness transparency. 2. Ensure AI governance is consistent laws regulations.Including responsibilities frameworks assess review throughout entire life cycle AI, e.g.with model monitoring.

Insurtech companies leveraging technology innovate disrupt industry. startups focus making insurance accessible, affordable, efficient. Key trends include: On-Demand Insurance: Customers purchase coverage specific events timeframes, travel single-day activities, mobile apps.

Insurtech companies leveraging technology innovate disrupt industry. startups focus making insurance accessible, affordable, efficient. Key trends include: On-Demand Insurance: Customers purchase coverage specific events timeframes, travel single-day activities, mobile apps.

Now, companies aware data the challenge that there's risk doing pilots being ready scale. is need discuss gather cases across business overpromising. insurance companies, brokers, carriers probably a place now.

Now, companies aware data the challenge that there's risk doing pilots being ready scale. is need discuss gather cases across business overpromising. insurance companies, brokers, carriers probably a place now.

Life insurance a data-fuelled business model makes an industry appears, the surface, be primed the technological advances artificial intelligence (AI) offer. Insurers seeking opportunities use AI addressing challenges face an increasingly digital world.

Life insurance a data-fuelled business model makes an industry appears, the surface, be primed the technological advances artificial intelligence (AI) offer. Insurers seeking opportunities use AI addressing challenges face an increasingly digital world.

It been interesting year insurers. Profitability U.S. property/casualty insurers improved 2024, driven substantive rate increases tighter risk appetite.

It been interesting year insurers. Profitability U.S. property/casualty insurers improved 2024, driven substantive rate increases tighter risk appetite.

6 Ways You Can Benefit from Insurance Business Intelligence - Hitachi

6 Ways You Can Benefit from Insurance Business Intelligence - Hitachi

Business Intelligence - Commercial Insurance Associates - YouTube

Business Intelligence - Commercial Insurance Associates - YouTube

Risk Assessment In The Insurance Industry

Risk Assessment In The Insurance Industry

Enhancing Business Intelligence with Power BI - AaarmTech

Enhancing Business Intelligence with Power BI - AaarmTech

WHY BUSINESS INTELLIGENCE IS VITAL TO THE SUCCESS OF THE INSURANCE

WHY BUSINESS INTELLIGENCE IS VITAL TO THE SUCCESS OF THE INSURANCE

Solutions - Professional - Community

Solutions - Professional - Community

Driving Effective Risk Management through Business Intelligence | Bold BI

Driving Effective Risk Management through Business Intelligence | Bold BI

5 ways insurance benefits from business intelligence

5 ways insurance benefits from business intelligence

Managing Risk with Insurance Risk Analytics

Managing Risk with Insurance Risk Analytics

An Example Of Business Intelligence Bi Is To Help Managers - businesser

An Example Of Business Intelligence Bi Is To Help Managers - businesser